A decline in ABS Housing Finance figures for February 2012 continues a string of weakening housing updates, said the Housing Industry Association.

“Leading housing indicators are deteriorating in 2012, pointing to further weakening in already very soft new home building conditions,” says HIA chief economist, Dr Harley Dale.

“New home building, as a bellweather sector of the Australian economy, is clearly signalling weaker growth in 2012,” says Harley.

“Policy makers have misread the Australian economy and action is required now. A 50 basis point cut in interest rates is required on 1 May and the banks need to pass that on that in full. The Federal Government needs to abandon its 2012/13 surplus pledge as it risks doing serious damage to the Australian economy. State as well as Federal governments need to look closely at housing policy reform to boost new housing supply and bolster household and business confidence.”

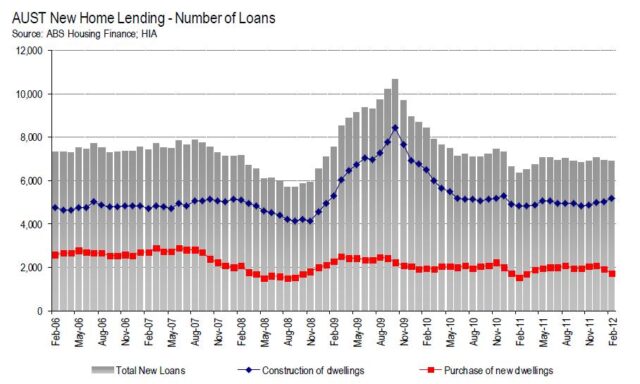

The total number of seasonally adjusted loans for owner occupiers fell by 2.5% in February 2012, dragged down to an extent by a hefty drop in first home buyer loans in New South Wales. Loans for the purchase of a new dwelling dropped by 10.4% in February, but loans for construction increased by 3.1%, meaning that total loans for new dwellings eased by 0.6%. Loans for existing dwellings net of refinancing fell by 4.2%.

In February 2012 the seasonally adjusted number of loans for new housing (construction and purchase of new) fell by 5.8% in New South Wales, 1.3% in Victoria, 2.1% in Western Australia, and 26.9% in the Northern Territory. There was a rise of 4.9% in Queensland and positive results were also recorded for South Australia (+2.8%), Tasmania (+18.3%), and the Australian Capital Territory (+7.0%).